Internet Safety for Seniors

In the United States, people over the age of 65 have the highest average net worth by age group at $1.2 million (USD). This makes them a favorite target among financial scammers who are looking to take advantage of their age. Unfortunately, they are also the least likely to report financial fraud.

The negative impacts of fraud are not only financial but also mental and emotional. Victims feel shame, grief, and anxiety after the fact. And since many of them live alone, coping with it is often a hard and difficult process.

Senior Scam Statistics

- The United States Federal Bureau of Investigation (FBI) says seniors lose $3 billion per year to financial abuse.

- In 2022, the US Federal Trade Commission received more than 200,000 fraud complaints from people between the ages of 60 and 69.

- There are more than 300,000 fraud cases targeting the elderly that are reported to the authorities every year.

- One in 6 adults aged 60 and above experience abuse in a community setting, according to the World Health Organization.

- The average loss per scam incident costs around $120,000 (USD)

- Analysis done by research company Comparitech found that older adults aged 60 and above are less likely to report losing money to fraud.

- A NY study reveals that only 1 in 44 cases of financial fraud among older adults gets reported.

- The most common scams include calling the senior posing as an official from a government agency or posing as a family member, law enforcer, or doctor to bait the victim into thinking that their loved ones have fallen ill and are in need of money.

- Seniors are also highly vulnerable to hackers, online shopping scams, sweepstakes and lottery scams, and romance and tech scams.

- Telemarketing is the most common contact method among scammers.

- According to the McAfee Cybersecurity Artificial Intelligence Report 2023, AI scams might cost older adults an estimated $100 Billion by 2025.

Image by Andrea Piacquadio on Pexels

Image by Andrea Piacquadio on Pexels

Reasons Why Seniors Are Frequent Targets of Scams

The FBI’s Common Fraud Schemes - Fraud Target: Senior Citizens offers the following reasons why scammers often target and exploit elderly adults.

- Seniors are most likely homeowners, have savings, and have excellent credit

- Generations who grew up between the 1930s to the 1950s are generally more trusting and polite

- Senior citizens are less likely to report fraud

Common Types of Scams Targeting Seniors

The following are the most prevalent type of senior-targeting fraudulent schemes. Being informed of what these scams are and how they work and can help you or your loved one be vigilant and safe online.

1. Fake Medical Insurance Plans

This scam involves reaching out to the victim and offering them complete medical coverage at incredibly low prices. Some scammers might even say that their offer is required or mandated by the Affordable Care Act or Medicare. However, when the victim eventually uses the plan, they realize that the coverage is useless or barely covers anything.

If someone contacts you offering medical coverage that sounds too good to be true, it probably is. Avoid signing any plan especially if you feel pressured to do so quickly. Read the terms of the plan carefully, and verify the identity of the agent or the organization they represent independently.

2. Tech Support Scams

There are different ways tech support scammers contact their victims:

Via phone calls

The scammer contacts the victim posing as a representative from a well-known company such as Microsoft. They will tell the victim that they found a problem in the victim’s computer and will ask the victim to install specific programs so they can get remote access to the victim’s computer and fix the problem.

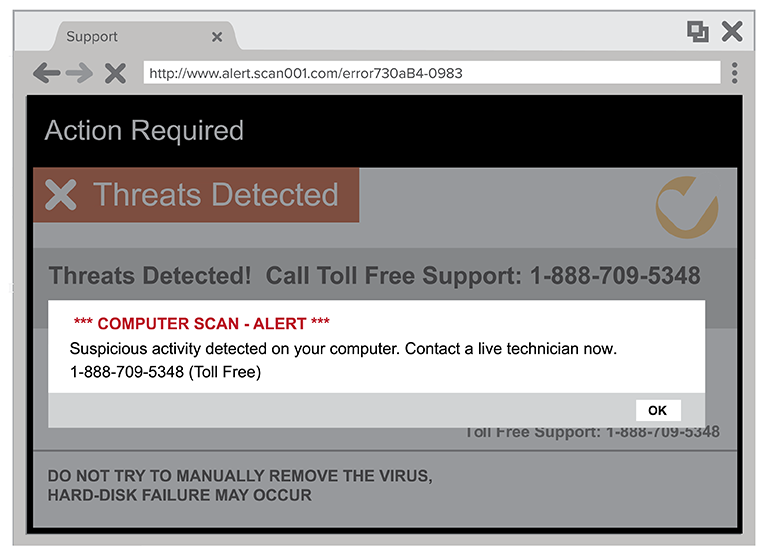

Pop-up warnings

A window may pop up randomly while the victim is browsing the internet. This popup message contains an urgent warning about a potential issue with the victim’s computer and includes a toll-free number that they can call to get help fixing the problem. Below is an example of such a popup.

Source: FTC official website

Source: FTC official website

REMEMBER: Big companies like Microsoft never ask their customers to call a number or click on a link. They will also not contact you via phone, email, or text message if there are issues with your computer.

If you think there’s a problem with your PC, the FTC recommends the following.

- Update your computer’s security software or have someone you trust do so

- Go to your software company’s official website and ask if they offer technical support

- Go to a computer shop and get help in person

Related: Why Privacy Matters in a Digital World (and Tips to Protect Your Personal Data)

3. Robocall Credit Card Interest Reduction Scams or Debt Relief Scams

These scams contact their victims telling them that they can shave off thousands of dollars in their credit card payments if they avail of a limited-time offer to lower their interest rates for a fee.

The scammers will say that they have a special relationship with the credit card companies and unions — not true. They will say that the offer is for a limited time offer only to pressure the victim to pounce on the offer immediately. They may also promise that the victim can get their money back if they can’t get the fee lowered — a false claim and will often result in the credit card owner paying for extra balance transfer fees, among other fees that they don’t tell the victim about.

To avoid these scams, always be skeptical of any unsolicited calls over the phone. Never give your personal and financial information to someone over the phone.

If you really want to lower your credit card interest rates, contact your credit card company directly.

Here are other tips for preventing robocall scams, according to the American Association of Retired Persons (AARP).

- Freeze your credit report to make it harder for identity thieves to open a new account in your name.

- Add your phone number to the Do Not Call Registry online. It won’t completely prevent robocalls, but it will make it harder for them to contact you.

Image from Unsplash

Image from Unsplash

4. Business Opportunity of Investment Scams

Business opportunity scams lure their victims by promising them huge amounts of money that they can potentially earn after signing up for or purchasing certain programs, courses, or services.

Often, these schemes involve pushing prepackaged small business deals purported to give the would-be victim a chance at financial independence or easy income.

If someone is offering you to sign up for a business deal, the State of California Department of Justice offers the following tips.

- Check out the legitimacy of the business with the Better Business Bureau

- If you feel pressured to take on the offer quickly, that’s a red flag

- Ask the business to see and review their government-mandated disclosure forms

- If the business involves selling products or services to customers, sample the products or services with actual potential customers first and see if they are actually interested

- Be skeptical about offers that promise over-the-top results but don’t give out many details

- Be skeptical if they immediately give you a discount after you initially refuse or say NO

- Beware of “money-back” guarantee promises as these fraudulent companies are most likely not going to follow through

- Beware of cold calls, especially if you didn’t sign up or ask to be contacted

- Insist on putting any offer into writing

- Be skeptical about advertising - just because you saw an ad on TV or in a magazine doesn’t automatically make the business legit

- Ask questions about the business’s location, years of service, how the business works, how you earn the money and by whom and when, the overall cost of getting the business into operation, and how the potential earning calculations were made.

5. Money Transfer Systems Fraud

There are several ways scammers can trick victims into wiring them willingly. One method is contacting the victim and asking them for help transferring a huge sum of money overseas. The fraudster promises to give the victim a share of the money if they share their bank account information to "assist" with the transfer. The scammer can then withdraw money directly from the victim’s account or they may claim that the victim needs to pay them a fee to do the transfer.

Other methods scammers use to commit money transfer fraud include:

Charity Donation Scams

Scammers pose as representatives of charity organizations to trick victims into wiring them money.

Classified ad purchases scams

Some scammers post product or service advertisements to popular online selling sites. The victim usually pays for the product or service in advance but the supposed seller does not send the product or does not follow through with the service.

Lottery and Sweepstakes Scams

This involves contacting the victim and telling them they’ve won a contest they didn’t join. The scammer asks the victim for a fee for them to receive and claim their prize.

Image by Marcus Aurelius on Pexels

Image by Marcus Aurelius on Pexels

Phishing

The scammers gain the victim’s financial information via email. They may pose as a representative of a bank or well-known financial company or they may use malware to gain access to the person’s computer.

Relatives in need of help

Scammers can pretend to be a distant relative or a relative of a friend asking for help because they’re in a rough situation. They may say they’re stranded abroad or were mugged and are in need of money.

Stranded Traveller Scam

In this scam, a fraudster hacks an email account, sends messages to all contacts, often pretending to be stranded in a foreign country due to a robbery, and asks for a loan to come back home.

To avoid being a victim of a money transfer or bank transfer fraud, never respond to unsolicited correspondence without vetting their authenticity.

6. Real Estate Scams

There have been many recorded types of real estate fraud but the most common and notorious ones include the following.

Commercial Real Estate Scam

Commercial real estate fraud takes different forms but one common type involves misusing funds by borrowers – they divert money from loans or payments to unauthorized expenses, like using rent money for a different property's costs. Fraud also often includes tricks like submitting fake papers or misleading financial statements.

Foreclosure Rescue Schemes

This scheme targets homeowners who are in foreclosure, in danger of foreclosure, and those who are unable to refinance their mortgages. The scammers promise to help the victims to prevent the impending disaster from happening — for a fee but doing little to nothing about it.

Home Inspection Scam

A home inspection is done to determine the fair market value of the property. A home inspection scam takes place when a fraudulent inspection personnel is hired and hides potential problems in the home so the buyer ends up paying more than they should.

Loan Flipping Scam

This occurs when scammers convince their victims, often seniors who have built high equity in their homes, to repeatedly refinance their homes. The victims end up getting high loan payments that they eventually will not be able to afford.

Rental Scam

Scammers will sometimes list apartments or other rental properties online, often at low prices, to bait potential renters to wire them money as advance deposits.

Title or Deed Scam

This type of scam involves transferring the ownership of a property without the owner's knowledge, resulting in the loss of their home.

Value Fraud

This happens when the seller of the property provides a buyer with incorrect information about the property's actual value.

Image by Artyom Kabajev on Unsplash

Image by Artyom Kabajev on Unsplash

How to Avoid Real Estate Scams

- Only work with certified agents, lenders, and other real estate professionals. Verify their identity before doing business with them.

- Never give your personal and financial information to someone you haven't vetted.

- Refuse to pay upfront fees

- Take the time to verify any last-minute changes.

- Avoid engaging in off-market transactions.

Related: Why Privacy Matters in a Digital World (and Tips to Protect Your Personal Data)

7. Negative Option Marketing

These fraudulent companies offer their victims free trials of their products if they agree to pay for shipping. What the victims don't know is the company also sneakily signs them up for pricey product deliveries without their permission. If the victims don't cancel the free trial fast, the company charges the full price. Scammers also use this trick to make the victim pay for things they never wanted, selling stuff like skincare, weight loss, quit-smoking items, and subscription plans.

To avoid falling victim to negative option marketing scams, follow these tips.

- Research the company before making any purchase or giving your credit card information.

- Read the company's terms and conditions.

- Be skeptical of free trial offers. If you do sign up, make sure you have a reminder for when to cancel your subscription.

- Regularly check your bank statements.

- Use strong passwords for your email and online accounts.

- Keep receipts of your transactions.

- Report scams.

8. Anti-Aging/Health Claims

Health remains one of the foremost ongoing concerns among seniors, and scammers capitalize on this fact by offering deceptive health-related products and services that yield minimal to no results. Consequently, those who fall victim to these schemes sign up, only to realize that they need to continuously avail themselves of the product or service in order to achieve the promised results. Subsequently, they expend substantial sums of money on these products, which are either mere placebos or may even comprise toxic chemicals that do more harm than enhance their health.

As a senior, here are some tips to help you protect yourself from these health scams.

- Consult your doctor and other health professionals before trying new products.

- Be skeptical of miracle claims. If it seems too good to be true, it probably is.

- Check if the claims are backed by actual scientific research.

- If you feel pressured to buy the product immediately, it's probably a scam.

- Read reviews and testimonials critically.

- Do not sign up for "free" trials before reading the terms and conditions.

- Don't click ads and links that randomly pop up online. Look for that "X" button at the upper right corner of the ad to immediately close popups.

- Report suspicious sales activity to the FTC to help prevent others from falling victim to these fraudulent activities.

- Trust your instincts. If something doesn't feel right, you're probably right.

9. Grandparent Scams

Grandparents are generally fond of their grandchildren so when they come looking for help, grandparents are always to the rescue. Unfortunately, scammers also know this all too well and are always looking to take advantage of a grandparent’s good heart.

Grandparent scams generally involve the scammers contacting the potential victim and pretending to be their grandchild in distress. They then proceed to ask the victim for financial assistance. Scammers go to such lengths as replicating the supposed grandchildren’s voices via a short audio sample using artificial intelligence tools to make the call more believable to their victims.

The FCC warns seniors to be vigilant about scam calls and to avoid sending any money so quickly especially if you feel like you’re being pressured to do so. The FCC also encourages seniors to use call-blocking tools and other resources.

Image by Anna Shvets on Pexels

Image by Anna Shvets on Pexels

10. Romance Scams

Seniors aged 60 to 69 lost an average of $6,688 to romance scams according to California Mobility.

Romance scams happen when a scammer reaches out to a potential victim online, often through dating sites or social media. They work to win the victim's affection and trust, only to exploit that trust and take money from them. In some cases, scammers can deceive victims for an extended period before the victim realizes the true situation. By that point, the victim may have already lost a significant amount of money. Some victims who truly believe in their scammer’s romantic intentions end up losing their entire life savings, their homes, and their self-esteem.

Here’s how to spot a scammer on a dating site.

- You cannot find information about them online. Most people have online footprints but these people seem to live under a rock.

- They are quick to declare their romantic intentions to you. This is called “love bombing” and is designed to quickly hook an unwitting victim to their ruse.

- They look perfect. They have magazine-quality photos. When you do find some information about them online, you will usually find the same photos that they send to you.

- They have plenty of excuses when you ask them to meet up in person. They may say they’re always traveling or live far away from you. They may also use frequent family drama as an excuse to always be somewhere else.

- They talk about investments and ask for your financial help. They might also convince you to join in on these investments such as in cryptocurrency.

- They ask for too much personal information. Some scammers might not only manipulate you to steal from you but also to steal your identity.

- They ask to talk outside of dating apps.

Dating online is tough for most people. As a general rule, do not place your trust too quickly on someone you’ve never met, especially if they are very quick to tell you all the right things to get your affection. Take it slow, research them online, and never give them money, especially if it feels like it’s the only thing that will gain their affection.

11. Home Repair Fraud

Numerous forms of home repair fraud specifically target vulnerable seniors living alone. Many of these deceitful contractors go door-to-door seeking potential victims. They inspect properties and then inform the owner about supposed necessary repairs. There are various ways these fraudsters operate.

- They ask for a large deposit and don't come back to do the work.

- The do the work but the work is too substandard that the owner might need to hire another contractor to redo the job.

- They may do the work but after the job is done, they pressure or bully the owner into paying them a higher price.

- They may alter checks to get a higher payment.

- They may find victims with disabilities such as impaired vision, mental states, or physical abilities and repeatedly charge them for work that was never done or have already been done.

To avoid this scam, follow the tips below.

- Never answer the door to contractors who “happen to be in the neighborhood”. There are plenty of easy ways to find legitimate, credible contractors.

- Ask for their credentials. If they refuse or make excuses, that’s a red flag. Refuse the service there and then.

- If they pressure you to put a down payment for the service, that’s usually not a good sign. Never pay money upfront for work that hasn’t been done, especially if they cannot give you proof of licensing.

- Be skeptical if they offer you discounts or limited-time deals. Of course, not all contractors who offer discounts are scammers, but if they seem pushy about it, refuse right away.

- Ask them to sign a contract before doing any work. A legitimate contractor shouldn’t have any qualms about signing legalities.

Image from Unsplash

Image from Unsplash

How To Tell If You’re Being Scammed

Recognizing the signs is crucial to avoid falling victim to these scams. Here are the most common signs that you might be being deceived.

- They contact you out of the blue. You may receive an SMS, email, letter in the mail, or social media message from someone you don’t know or from a very well-known company or government agency whom you haven’t contacted before.

- You are pressured into taking action immediately. They may be dangling a very sweet deal, a limited-time offer, or using the trust you built with them to do something for them that you don’t really want to do.

- They ask for your personal information. Most scammers may manipulate you into giving up your personal or financial information as a sign of your commitment to them.

- It doesn’t feel right. Sometimes, you just have to trust your gut instinct. If something about it feels off, it’s probably is.

- They ask you to install something on your phone or computer. It may be an app, a software, an update, etc. This can also happen when you click on a random link online and it asks you to install something. Do not install anything that you cannot verify at all costs.

- They use emotions to manipulate you into wiring them money. If they ask you to invest in something or to loan them money after you have given them your trust and confidence, be very suspicious.

- They promise you something that sounds too good to be true. Be very skeptical if they promise you something that makes you really excited or makes you want to sacrifice a significant portion of your finances.

- They declare their love for you after a few interactions. Scammers will make their victims feel special in order to gain their affection and trust. It is through this built-up trust that the manipulating and lying comes through.

How to Avoid Scams

There are some precautionary measures that you can take to avoid interacting with or falling victim to scammers.

- Ask for credentials. If someone contacts you out of the blue representing some well-known company or government agency, ask for the full name and their credentials, then take steps to look them up online or call up their company to verify their information. If they make excuses or you are unable to verify their identity based on the information they gave you, avoid doing business.

- Question the company’s claims and motives. Ask for as much information as possible. Look for signs of over-promising. Be skeptical of claims that sound too good to be true, especially regarding health and finances.

- Never share your information over the phone. Regardless of how legit you think a company is, never give out your personal and financial information over the phone.

- List your phone number on a Do Not Call list. You can enter your number through the Do Not Call Registry here. It may not screen all scammy phone calls but it will make it harder for scammers to contact you.

- Monitor your accounts. Consistently check your bank statements and look for unfamiliar purchases. Enlist the help of someone you trust to remind you or do this for you on a regular basis.

- Safeguard your PC. Take your PC to a legitimate computer shop or have a trusted individual regularly update your computer programs and make it secure.

- Avoid clicking any links. If you come upon a page online that asks you to click on a link to “fix an issue” or “claim or prize”, among others, close the page immediately.

- Make your social media accounts private. And on that note, only accept connections invitations or friend requests from individuals you know personally. This will make your contact information and personal posts only visible to only people you know.

How to Report a Scam

First, gather the following information:

- Name of suspects or witnesses.

- Date, time, and frequency of the incidents.

- Location of the incident.

- Description of the scam.

And then, contact the authorities to give them notice.

Hotlines and reporting tools

The U.S.

- Call Eldercare Locator at 1-800-677-1116 for help and support or visit:

- IdentifyTheft.gov to report identity theft (FTC)

- Elder Abuse Resource Roadmap to report financial abuse (DOJ)

- ReportFraud.ftc.gov to report fraud to the Federal Trade Commission (FTC)

- United States Postal Inspection Service – to report mail or postal fraud (USPS)

UK

- Call Action on Elder Abuse helpline at 0808 808 8141 or visit:

- Action Fraud to report fraud and cybercrime (UK Police)

- Support for scam victims for resources and reporting tips (AgeUK)

Australia

- Call the Elder abuse helpline at 1300 651 192

Canada

- Visit the Government of Canada to find help

Final Word

Opportunities and fraudsters take advantage of seniors’ vulnerability and kindheartedness to rob them of not just their life savings but also their sense of independence. Being and staying informed will help you or a loved one stay safe as you navigate the complex world of the internet.

Download TaskSpur on Android | Download TaskSpur on your iPhone

Sign up or Login on your browser

References

- Desiata, F. (2023, June 2). How many senior scams happen yearly? [Elder Fraud Statistics 2023]. Sirisha. https://dataprot.net/statistics/senior-scam-statistics/

- Admin-Calimobility. (2023, July 6). 6 Senior Citizen Scam Statistics You Need To Know In 2023 [Infographic] - California Mobility. California Mobility. https://californiamobility.com/senior-citizen-scams-statistics/

- Smith, M., MA. (2023). Elder scams and senior fraud abuse. HelpGuide.org. https://www.helpguide.org/articles/abuse/elder-scams-and-senior-fraud-abuse.htm

- Rubin, E. (2022). How fraudsters target older adults in 2021. ConsumerAffairs. https://www.consumeraffairs.com/finance/elderly-financial-scam-statistics.html

- Glamoslija, K., & Glamoslija, K. (2023). The Ultimate Internet Safety Guide for Seniors in 2023. SafetyDetectives. https://www.safetydetectives.com/blog/the-ultimate-internet-safety-guide-for-seniors/

- Prevalence & Statistics — NYS E-MDT. (n.d.). NYS E-MDT. https://www.nysemdt.org/prevalence-statistics#:~:text=Studies%20have%20found%20that%20at,abuse%20in%20the%20past%20year.

- Murray, K. (2023). U.S. Net Worth statistics: The state of Wealth in 2023. FinanceBuzz. https://financebuzz.com/us-net-worth-statistics

- Gitnux. (2023b). The Most Surprising Living Alone Statistics And Trends in 2023 • GITNUX. GITNUX. https://blog.gitnux.com/living-alone-statistics/

- Beware of fake health plans. (n.d.). Disb. https://disb.dc.gov/page/beware-fake-health-plans#:~:text=Fake%20health%20plans%20promise%20full,full%20benefits%20at%20low%20prices.

- Investor bulletin Business opportunity fraud. (n.d.). CT.gov - Connecticut’s Official State Website. https://portal.ct.gov/DOB/Consumer/Consumer-Education/Investor-Bulletin-Business-Opportunity-Fraud

- Job Schemes and Business Opportunity Schemes. (n.d.). State of California Department of Justice. https://oag.ca.gov/consumers/general/job-business-schemes#top

- Dev.Login. (2023). What is Bank Transfer Fraud and have you been involved? St Pauls Chambers. https://www.stpaulschambers.com/what-is-bank-transfer-fraud-and-have-you-been-involved/

- Common scams and crimes. (2023, August 24). Federal Bureau of Investigation. https://www.fbi.gov/how-we-can-help-you/safety-resources/scams-and-safety/common-scams-and-crimes

- How To Avoid These 7 Real Estate Scams. (n.d.). Rocket Mortgage. https://www.rocketmortgage.com/learn/real-estate-scams

- The National Council on Aging. (n.d.). https://www.ncoa.org/article/22-tips-for-seniors-to-avoid-scams

- Admin-Calimobility. (2023b, July 6). 6 Senior Citizen Scam Statistics You Need To Know In 2023 [Infographic] - California Mobility. California Mobility. https://californiamobility.com/senior-citizen-scams-statistics/

- How To Spot a Scammer on a Dating Site: 9 Warning Signs. (n.d.). https://www.aura.com/learn/how-to-spot-a-scammer-on-a-dating-site#:~:text=They%20may%20ask%20you%20to,why%20they%20can't%20meet.

- Home Repair Fraud | Contra Costa County, CA official website. (n.d.). https://www.contracosta.ca.gov/921/Home-Repair-Fraud

- Avoiding home repair scams | Five star painting. (n.d.). https://www.fivestarpainting.com/about-us/expert-tips/home-improvement/home-improvement-fraud-what-it-is-and-how-to-avo/

- 10 signs scammers have you in their sights. (2023, February 15). https://www.welivesecurity.com/2023/02/15/10-signs-scammers-sights/